DIRECTIVE 2014/55/EU OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on electronic invoicing in public procurement provided for the adoption of a European Standard, in order to reduce obstacles deriving from the coexistence of different legal requirements and from the lack of interoperability in cross-border and trans-sectoral exchanges, as well as in order to ensure semantic interoperability and to improve legal certainty.

The Directive mandated the CEN (European Committee for Standardization) to develop a European standard (the so-called “Norm”) for the semantic model of an electronic invoice and to define a list of syntaxes compliant with the semantic model and the corresponding mappings. In October 2017, the European standard (EN 16931-1:2017) and related syntaxes were formally referenced by the European Commission. These syntaxes are:

-

the UBL invoice and credit note messages defined by the ISO/IEC 19845:2015.7 standard;

-

the UN/CEFACT XML Cross Industry Invoice message as defined by the XML 16B (SCRDM-CII) schemata.

Directive 2014/55 was implemented in Italy by the Legislative Decree no. 148 of 27 December 2018, entered into force on 1 February 2019, which applies to contracting authorities and contracting entities referred to in article 1, paragraph 1, of the legislative decree 18 April 2016, no. 50, as well as to the public administrations referred to in article 1, paragraph 2, of the law of 31 December 2009, no. 196. Subsequently, with Provision no. 99370 of 18 April 2019 by the Revenue Agency (Agenzia delle Entrate), both the implementation rules for European electronic invoicing in public procurement and the technical specification (the so-called Core Invoice Usage Specification, or CIUS) for the use of the syntax in the Italian context were approved.

The Italian transposition therefore made the receipt, translation and delivery of electronic invoices compliant with the European standard (EN16931) mandatory, through the national Electronic Exchange System (SdI), in two phases:

-

from April 18, 2019 for central government authorities;

-

from 18 April 2020 for other regional and local contracting authorities.

THE PEPPOL NETWORK INFRASTRUCTURE

The update of the national electronic invoicing infrastructure to ensure the full adoption of the European electronic invoicing, messaging and eDelivery (PEPPOL) profiles was carried out thanks to the EeISI (“European eInvoicing Standard in Italy”) and eIGOR (“elnvoicing GO Regional”) projects, co-financed by the European Commission through the CEF Connecting Europe Facility funding instrument.

Moreover, thanks to the integration between the PEPPOL SMP and iPA (“Indice delle pubbliche amministrazioni”, the national register of public bodies in Italy) carried out as part of the EeISI project, all Public Administrations can select their own Access Point on iPA itself: such AP will then act as an intermediary for the invoices received over the PEPPOL network.

In order to get started transmitting invoices compliant with the European format European via the PEPPOL network, it is necessary that:

-

the Public Administration adopts a service provider which is both a Certified PEPPOL Access Point and a qualified intermediary towards the Revenue Agency’s SdI;

-

the PA sets up the PEPPOL reception channel for the electronic billing offices on the iPA register, thanks to the aforementioned integration between the SMP and iPA itself.

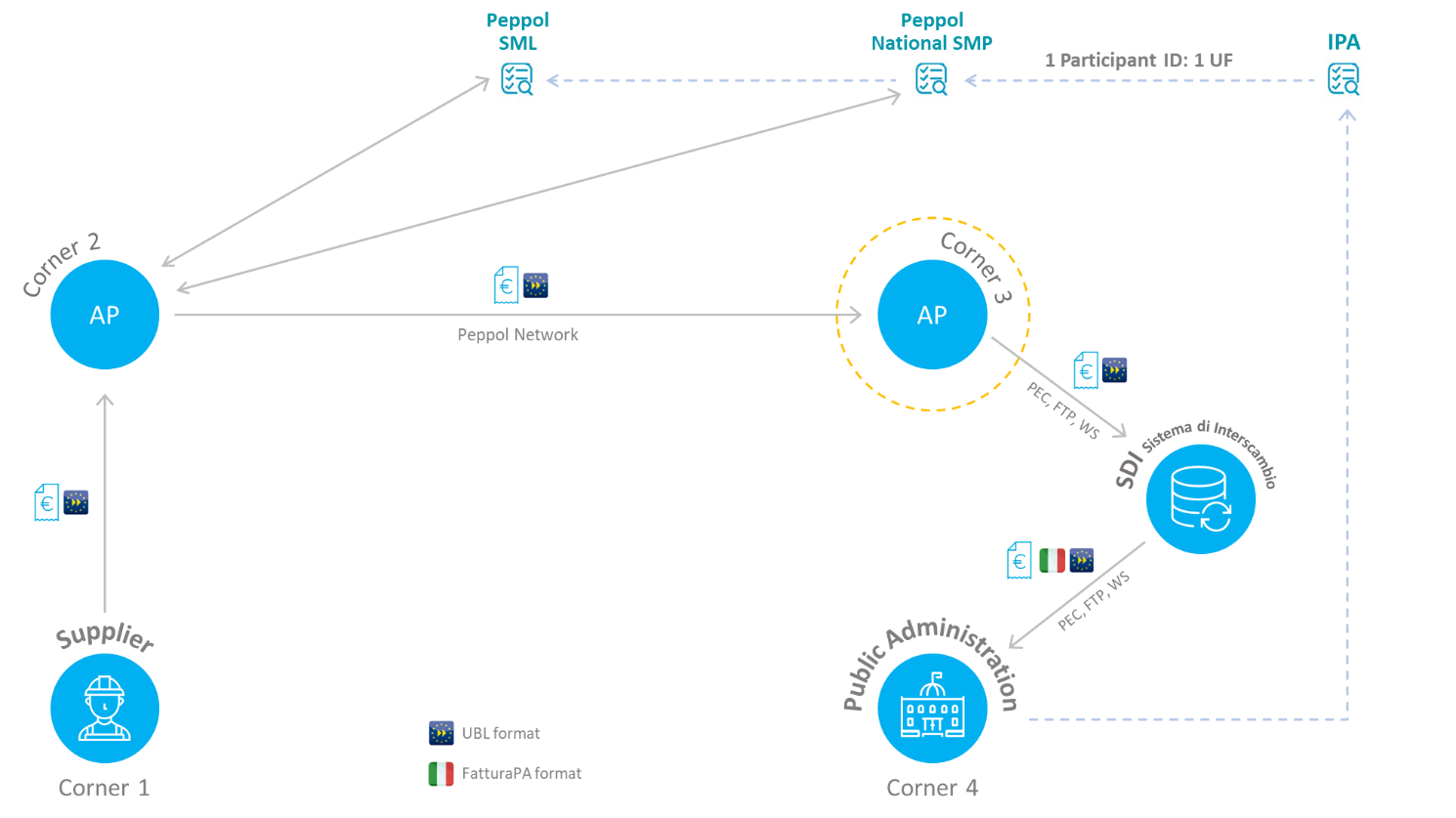

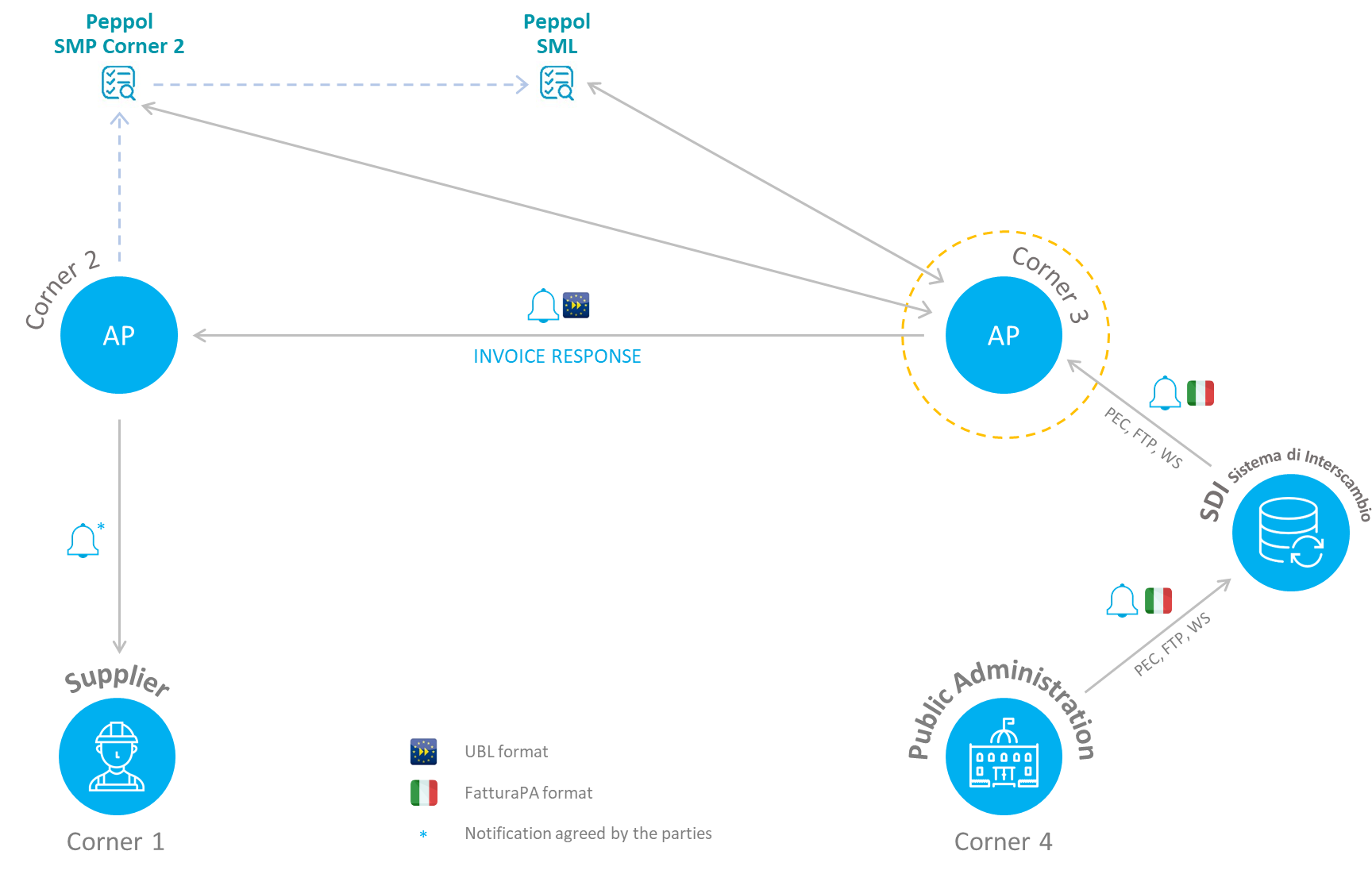

The following two illustrative diagrams explain respectively the invoice transmission flow and the return flow of notifications:

| STEP | DESCRIPTION |

|---|---|

| 1 | The Economic Operator (Corner 1) sends the Peppol BIS 3 document (CIUS-compliant) towards its own Access Point Provider (Corner 2) specifying the receiver (the Public Administration’s UFE endpoint from iPA) |

| 2 | The Access Point Provider (Corner 2) uses PEPPOL’s dynamic discovery (lookup on SML and SMP) to identify the Access Point (Corner 3) to which it must deliver the document addressed to the PA |

| 3 | The Access Point Provider of the Economic Operator (Corner 2) sends the document to the Access Point Provider of the Public Administration (Corner 3) |

| 4 | The Access Point of the Public Administration (Corner 3) sends the document to Electronic Exchange System (SdI) using the traditional channels provided by SdI itself |

| 5 | SdI verifies the compliance of the document with the Italian rules, translates it into the FatturaPA national format and delivers it to the PA by attaching the original Peppol BIS 3 file, using the reception channels registered on SdI itself |

| STEP | DESCRIPTION |

|---|---|

| 1 | The Public Administration (Corner 4) sends to SdI the notification of receipt in FatturaPA format using the traditional SdI channels |

| 2 | SdI receives the notification and transmits it, in FatturaPA format, to the PA’s Access Point Provider (Corner 3) using SdI traditional channel |

| 3 | The Access Point Provider of the Public Administration (Corner 3) translates the notification from the FatturaPA format to the UBL format creating the Invoice Response |

| 4 | The Access Point Provider of the Public Administration (Corner 3) uses PEPPOL’s dynamic discovery (lookup on SML and SMP) to identify the Access Point (Corner 2) to which the Invoice Response must be delivered |

| 5 | The Access Point Provider (Corner 3) sends the IR notice on the PEPPOL network to the Access Point Provider of the Economic Operator (Corner 2) |

| 6 | The Access Point Provider of the Economic Operator (Corner 2) informs the original sender of the invoice (Corner 1) of the transmission outcome using a type of notification agreed between the parties |